how fast does an auto loan build credit

Those that dont could take a few days to get back to you. For example if paying off a car loan bumps your average account age from four to six it.

Award Winning Credit Union Advertising Marketing Case Study Mdg Advertising Banks Ads Car Loans Marketing Case Study

However a ratio below 10 will result in an even better score.

. Granted this method will make the auto loan drag on longer but at least this way you can afford payments and preserve your credit score. 3 factors affecting your car loan payment Most common types of loans You can use a car loan to purchase a new or used vehicle. As a rule of thumb its best to keep your credit utilization ratio below 30.

When you miss a payment or default on a loan it can take your credit score down a notch. Types of Credit and Length of Credit History. Unfortunately its much harder to build good credit than it is to destroy it.

So if you open a. But seriously a car loan is an excellent opportunity to get your feet under you credit-wise. Once your loan is repaid you could lose points if you dont have other installment accounts.

Having both revolving credit such as credit cards that allow you to carry a balance and. 1 FICO credit scores range from 300 to 850 and a score of over 700 is considered a good credit score. Of all the factors making up your credit score payment history is by far the most important.

Scores over 800 are considered excellent. Refinancing is a great way to hit the restart button on an auto loan. Based on FICO the most popular credit scoring model you can generate a credit score after six months of reported payment history.

When you finance a car youre adding to at least three areas of your credit profile which can help you improve your credit score. Pay in full weekly. A car loan also helps to improve your credit mix by diversifying the types of credit you have.

What builds your credit is regularly making payments on your car loan. While it takes three to six months just to accrue enough information in your file to be issued a credit score it can take much less time to reduce it. The older the better Pay your cards in full every month.

Late Payments According to FICO data a 30-day late car payment could drop your credit score as much as 90 points even if you never. When you take out an auto loan especially a bad credit car loan you gain the opportunity to make a positive impact on your credit by making all your monthly payments on time and in full. However if you have to visit a lenders office to apply in person it could take longer.

The biggest piece of the pie is payment history making up 35 percent of your credit score. Each time you make a payment your lender. Generally speaking if youre shopping for an auto loan within a 30-day period all those hard inquiries that are listed on your credit report will only count as.

Payment history makes up 35 percent of your FICO credit score which is the. If you have a five-year car loan for example the loan will affect your credit for a total of 15 years. The best way to build credit is to.

With an auto loan the car itself is the security so if you dont make your payments it can be repossessed. It will take about six months of credit activity to establish enough history for a FICO credit score which is used in 90 of lending decisions. The main reason a car loan is a good way to build and improve your credit score is because as you make payments on time you begin to build a positive payment history.

Payment history credit mix and new credit. Because keeping your auto loan can add or detract from your credit score its hard to say with certainty that paying off a car loan will boost it. Its not ideal to take out multiple loans at the same time because each time your credit score will likely drop.

A longer loan term will lower your monthly payment but increase the total loan cost due to additional interest charges. The car loan remains on your credit for the life of the loan plus another 10 years. An auto loan is an installment account that is one with a set term and a level payment every month.

Maintain one or two credit cards. Some lenders offer instant preapproval after you submit your application. In part thats because 35 of your credit score is based on timely payments.

For example if you have a thin credit file meaning you only have a few credit accounts a car loan will add to the number of accounts you have helping to build your credit history. Or every week as I do Never ever EVER be late on a payment. The impacts of a car loan start with the first inquiry on your credit score.

Paying off an installment loan as agreed over time does build credit. Though the longer loan term lowers your monthly out-of-pocket costs if you opt to pay the loan back in five years instead of three years youll end up paying an additional 788 in interest over the life of the loan. It all depends on your situation.

Dont expect a spectacular number right off the bat. In the event of a financial setback refinancing will reduce monthly auto loan payments. Adding to Your Credit Profile.

It makes up 35 percent of your FICO credit score. In fact the loan will lower your credit score initially because youve taken on extra debt. Easiest way to do this.

If youre planning on financing a car its possible to obtain an affordable interest rate on an auto loan even without excellent credit. Having a loan itself doesnt help build your credit. Automatic payments Keep your utilization ratio under 20 percent.

But the amount of time it. And if you make timely payments for five or more years on an installment loan thats a lot of goodwill for your credit score. The loan term or how long the loan lasts is usually 36 to 72 months.

Because car loans and other borrowing stays on your credit report for so long its important to pay on time every month. You can reduce the amount you borrow by making a down payment or offering your old car as a trade-in. The best way to make sure you get the most impact in this area is to pay all your monthly bills.

It usually only takes 10 to 15 minutes to complete an online application. Easiest way to do this. On-time payments on an auto loan will help you build your payment history.

Simplest Way To Get Sanctioned Through A Trader For Auto Loans Bad Credit Car Loan Car Loans Car Loan Calculator

Free Car Loan Application Form Car Finance Car Loans Bad Credit Car Loan

What Is A Credit Builder Loan Ways To Build Credit Best Money Saving Tips What Is Credit Score

What Is A Good Credit Score Gobankingrates Good Credit Score Credit Score What Is Credit Score

Get Out Of Your Car Loan Today Summit Of Coin Loans Today Car Loans Debt Solutions

9 Easiest Auto Loans To Get 2022 Badcredit Org

Fresh Start Auto Loans Car Loans Car Finance Fresh Start

How To Pay Off A Car Loan Fast 14 359 In 12 Months Car Loans Paying Off Car Loan Paying Off Credit Cards

Looking At Credit Stuff And Was Wondering How Accurate This Was Credit Score Infographic Credit Repair Improve Credit Score

7 Auto Loans For Bad Credit In 2021 Credit Karma

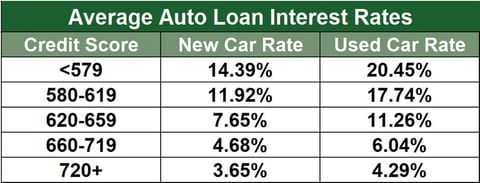

Auto Loan Rates By Credit Score Experian

What Credit Score Is Needed To Buy A Car Lendingtree

What S The Minimum Credit Score For A Car Loan Credit Karma

Why Doesn T My Auto Loan Show Up On My Credit Report Experian

Today We Take A Look At The Difference Good Credit Vs Bad Credit Can Make Bad Credit Can Still Get You Appro Credit Repair Good Credit Credit Repair Services

How To Increase A Credit Score To 800 5 Proven Tips Credit Repair Business Credit Repair Improve Credit Score

9 Easiest Auto Loans To Get 2022 Badcredit Org

How To Get A Car Loan With No Credit History Lendingtree

Characteristics Of Private Party Auto Loans Autoloan Autofinance Autofinancing Loans For Bad Credit Car Loans Bad Credit